Brainsphere IT Solutions would like to proudly announce that our ERP Software has been accredited by the UAE Federal Tax Authority (FTA).

Brainsphere IT Solutions is a globally recognized ERP solutions provider in Dubai, UAE for General Trading, Manufacturing, Contracting and Equipment Rental businesses. Facts ERP has achieved the UAE FTA accreditation for their Financial Module. Brainsphere IT Solutions has been one of the leading ERP and HR & Payroll Software provider in Dubai, UAE helping hundreds of companies in UAE with unique and customized solution post Value Added Tax policy implementation in UAE and in the Region.

“Facts ERP has been approved as a provider of the VAT-compliant accounting software in UAE by the Federal Tax Authority in UAE”

Brainsphere IT Solutions has 10,000+ Users globally using their world class ERP System, earned in the past 16+ years, to have a smooth transition following the new VAT implementation. UAE Government has implemented VAT from January 1, 2018, Brainsphere IT Solutions has played a major role in implementing VAT in more than 500+ companies in UAE with their ERP Software built in Dubai.

We are one of the best ERP companies in Dubai who has achieved the FTA certification for our accounting solution.

Let us take a deep look into FTA and Why VAT is implemented in UAE:-

What is FTA and why FTA approved ERP Software in Dubai, UAE is good for your business?

Federal Tax Authority is a government organization that framed and implemented the Value Added Tax Policy in UAE after thorough research with the help of Financial Advisors and Economist. VAT is a consumer tax collected at different stages of the business. As we all witnessed the technological advancement in all the government departments in UAE, FTA also want to make the business owners and corporates life much easy when it comes to tax filing. FTA went an extra mile to verify the software that adheres the VAT compliance and approved the same so that businesses can generate the VAT return file without any help VAT consultants or software vendors. Also, the FTA accredited software will help you save time and avoid expensive errors.

Below are some of the major requirements defined by the Federal Tax Authority for VAT compliance software.

- Capability to generate non-editable VAT return files.

- Capability to generate complete and accurate FAF file.

- Issue credit/debit notes, tax invoices, and invoices in compliance with VAT policy.

- Document control and support for auditors, the government, and users.

- Easy and secured data back-up options.

- Capability to generate weekly, monthly, quarterly, and annual reports.

- Role based user access to control and secure the data.

What is VAT?

VAT – Value Added Tax is general consumption tax collected fractionally at every stage of value addition to goods or services. As of 2016, more than 193 countries have implemented VAT. VAT is considered the best taxation procedure which collects tax at each stage of the supply chain process. Therefore, double taxation is completely avoided in this method. VAT is generally paid by the end consumer and businesses who involved in the supply chain process will collect the tax on behalf of the government.

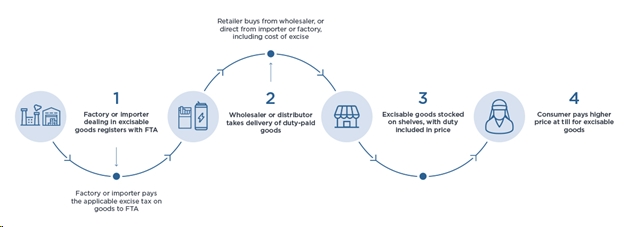

Below picture explains How VAT is collected at every stage of cloth production to end consumer.

Image Source: Ministry of Finance, UAE.

Why UAE is implementing VAT and Excise tax?

Why UAE is implementing VAT and Excise tax?

UAE government provide the citizens and residents with world class infrastructure includes public services like roads, hospitals, education, security, etc.., The expense for these services are taken care from the government budgets. Now, the new source of income through VAT will help the government to continue the best services they provide and also implement new services in the future. It will also help the government to reduce its dependency on the natural resources such as oil, hydrocarbons, etc..,

United Arab Emirates government and GCC countries have decided to implement VAT before January 2019. However, the UAE government have decided to implement VAT from 1st January 2018 onwards.

Excise tax is a form of indirect tax levied on some products which are considered harmful for humans and environment. Excise tax will be applicable for Tobacco products, Energy drinks and Carbonated drinks, rates are 100%, 100% and 50% respectively. Excise tax will be effective from 1st October 2017.

The reason behind doubling the cost of products like cigarettes, Energy drinks and Carbonated drinks is to reduce the consumption and increase the quality of life by consuming healthy products.

Image Source: UAE Government portal.

How VAT will affect people living in UAE?

UAE government have decided to levy 5% VAT – Value Added Tax for all goods and services. Therefore, the cost of living in UAE will slightly increase compared to previous years. It also depends on the life style of the family or individual. Example: Assume a person spends AED 5000 for luxury products in the year 2017 will spend AED 5250 for the same products in 2018. However, there are exemptions for certain essential category like education, healthcare and food items.

How government will collect the VAT from consumers?

Businesses on behalf of government collects the VAT and pay to the government. Seller will collect the VAT from buyer when goods or service sold, then the seller will deduct his/her input VAT credit and pay the remaining to the government. BrainsphereIT Solutions helps companies to implement VAT Enabled ERP and VAT Compliant Accounting Software in Dubai, Abu Dhabi, Sharjah, Ajman and other Middle East countries to make the business transactions and tax filing simple and quick.

The citizens and residents of the UAE enjoying the best in the world infrastructure for a long duration of time. The government took the responsibility and provided the best public services to the people from government’s budget. Now it’s time to pay back to the nation that served the people without any expectation like rain. This new policy and taxation system will bring more public participation and responsibility to the citizens and residents of UAE. Change is inevitable and it always shapes one better.