VAT in UAE, Value Added Tax in UAE

Checklist for VAT implementation in Dubai, Sharjah, Abu Dhabi, Ajman, RAK, Fujairah, UAE and GCC.

Gulf Co-operation Council (GCC) have decided to implement VAT in their respective countries before 1st January 2019. However, countries such as UAE and Saudi Arabia have decided to implement VAT by 1st January 2018. United Arab Emirates (UAE) already implemented excise tax for products like cigarettes, energy drink and carbonated drinks. GCC decided to implement Value Added Tax to generate additional revenue for the country and to reduce the dependency of the oil revenue.

All the businesses in UAE who have an annual turnover above AED 375,000.00 should register and get VAT registration number. Sales of any products or services should have the invoice and clear description of the products/services sold, VAT registration number and other details of buyer and seller. However, there are exceptions for few products/services like healthcare, education, etc..,

From 1st of January 2018, all business should start collecting 5% VAT on behalf of Government and file the return in the government portal. Since taxation is new for businesses in UAE, here is a quick checklist to refer before planning for VAT implementation.

Technology

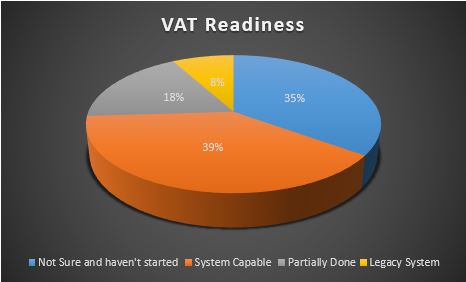

VAT enabled ERP software solution or VAT compliant Accounting Software is mandatory for billing your product or services from 1st of January 2018. Therefore, all the business in UAE should make sure that their existing ERP software or Accounting Software solution is updated with VAT compliance. Recently Thomson Reuters and Bayt.com done a VAT readiness survey in UAE. The study showed that about 35% of the companies in UAE is not sure whether their ERP software will support VAT or not. 39% of the companies already have VAT enabled ERP software solution. 18% of companies made partially VAT enabled ERP software. 8% of the companies are using legacy software which cannot adhere to the VAT. It high time to quickly evaluate your ERP Software or Accounting Software to find your company falls in which segment.

Human Resource

Educating your employees on VAT implications and creating awareness is mandatory. Finance, Sales, Marketing and IT team plays a major role in the successful implementation of VAT in the organization. The finance department has to balance the VAT credit and debt and file the tax return to the government on monthly or quarterly basis according to their convenience. Also, your team should ready to answer any billing related queries post-VAT implementation. Below is a quick example how VAT credit and debt are calculated?

| Company Name | Company Type | Item Description | Purchase | Sales | VAT | ||||||

| Purchase Price | VAT 5% | Total | Selling Price | VAT 5% | Total | VAT Credit | VAT Debit | VAT Payable | |||

| Best Supplies | Raw Material Supplier | Jute | — | — | — | 1000 | 50 | 1050 | 50 | — | 50 |

| Jute Manufacturing | Manufacturer | Bags | 1000 | 50 | 1050 | 1500 | 75 | 1575 | 75 | 50 | 25 |

| Best Jute Distributor | Distributor | Bags | 1500 | 75 | 1575 | 2000 | 100 | 2100 | 100 | 75 | 25 |

| Super Jute Store | Retailer | Bags | 2000 | 100 | 2100 | 2500 | 125 | 2625 | 125 | 100 | 25 |